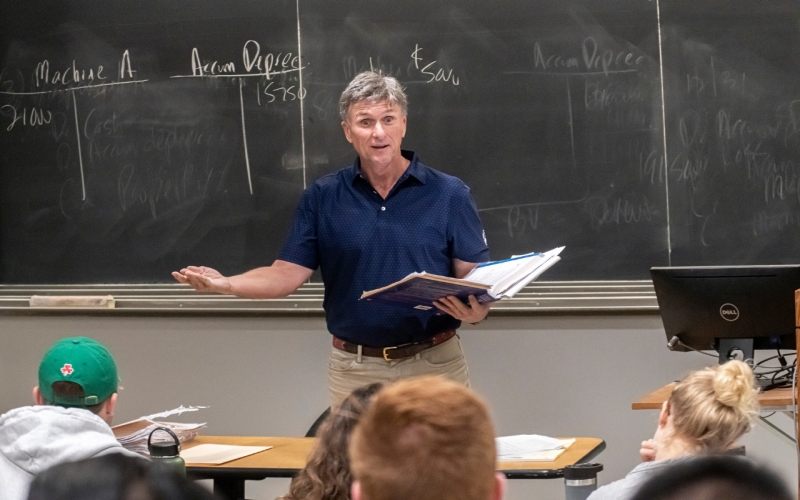

Starting off a Wednesday session of Advanced Federal Taxation, Senior Lecturer Edward Taylor raises what would seem a surprising question for such a class: “What’s the issue with Michael Jackson?” It’s no surprise to the 25 students, a fairly even mix of young men and women whose assigned reading included a Wall Street Journal story about a tussle between the IRS and the king of pop’s estate. The dispute centers on the taxable value of Jackson’s name and likeness. Estate executors put it at a microscopic $2,105; the IRS would like to tack on roughly another five zeroes.

After an exchange, Taylor prefaces the next brief discussion with the words “I’m not sure I should tell you this.” He bet a hundred dollars on the Patriots in the Super Bowl the weekend before, and his question is whether his winnings are taxable. They are, as the students know from another Journal story. A young man sporting an Eagles T-shirt asks if fantasy sports winnings are also taxable. “Yes, have you reported them?” Taylor replies with a smile. “Uh, not yet,” the student says. Then the class takes up news about early stirrings of tax reform in the Trump administration.

The Wall Street Journal occupies just the first 15 minutes or so of the twice-a-week class, but the assigned reading illustrates Taylor’s way of drawing students into the rigorous subject matter of tax accounting. The rules of that field are famously arcane and technical, yet this award-winning professor manages to deliver a sense of urgency to tax education—connecting it to what's happening in the world and in students’ lives.

A Carroll School alum, Taylor is reaching a milestone this semester. Since 1986, he has taught exactly 200 courses at Boston College including four this spring—and a total of 7,745 students.

His goal is always for students to “come to class thinking this is relevant to my life, and it’s actually fun,” says Taylor, who is also associate chair of the Accounting Department. He speaks of “bringing the world” into the classroom and the effect it has on accounting students. “It piques their interest because they’re talking about a real story. That’s what they remember most. They remember the stories,” he says.

It helps that Taylor is not just a creature of the classroom. Aside from his full-time lecturing and departmental responsibilities, he is also a partner in a Boston-area accounting firm that bears his name, Nardella & Taylor, LLP. In fact, Taylor’s experiences in the field supply many of the stories his students remember.

There was the time, for instance, when one of his clients sold a company for $80 million. “In my class, we walked through how the transaction was conducted,” he relates. “Or maybe somebody is being audited by the IRS,” Taylor adds. In that case, he steers the class through issues that arise in the audits.

Maria Battaglia ’17, an accounting student from Pittsburgh, says the principles of tax accounting can seem dry and abstract. “Sometimes it’s difficult to relate to it, so it’s great to have that connection,” she says, referring to both the headline news and Taylor’s stories from the front lines of practice.

200 Courses and Counting

Edward Taylor has been teaching at Boston College for 31 years. His 200 courses have covered topics such as financial accounting, managerial accounting, cost accounting, and auditing, as well as his speciality, federal taxation.

Read more about Edward Taylor »

Battaglia is enrolled this semester in Advanced Federal Taxation, an elective that helps with preparing for the CPA exam, particularly the regulatory section that deals with federal taxation as well as business law and ethics. A prerequisite course, Federal Taxation, is also taught by Taylor and is required of all accounting majors.

One of his quips—“The class pays for itself”—is echoed by Battaglia. She mentions a few things she learned that might help with her tax bills in the future, including the possible deductibility of moving expenses.

Tax Law Changing Before Their Eyes

Tax reform is in the air in Washington—and consequently in Taylor’s tax classes this spring.

“Tax law could be changing while we’re in the class, or by the time we go into the profession,” says Battaglia, who will be working after graduation in PwC’s Deals Practice, which handles capital market transactions such as IPOs and mergers and acquisitions. As examples, she cites reported plans to abolish the Estate Tax and the Alternative Minimum Tax.

Likewise, James Miller ’17 says the Wall Street Journal coverage of “tax issues under the Trump presidency isn’t just interesting. It’s very relevant to our lives as incoming professionals.” The New Jersey native cites, for instance, a February 8 Journal story under the headline “GOP Tax Proposal Splits Business into Factions.” Discussed that day in class, the story dealt largely with a Republican proposal to impose a levy on imports, which would hurt importers (retailers and their customers, notably) but in other ways help exporters.

It’s of more than theoretical interest to Miller: This coming fall he’ll be working as part of KPMG’s Corporate & Business Tax Services team in New York.

Professional training aside, Taylor points out: “It’s a real education to read about how the whole system works, how Washington works. It’s a civics lesson, in a way. And there’s a lot of anticipation about what’s coming with tax reform.”

Along with the world, Taylor also brings his love of Boston College into the class. Both he and his wife, Kimberly (Ladd), are alums of the institution, and each of their three children either has graduated from or is attending the University. His office in Fulton Hall is decorated with Boston College banners, pennants, and other displays of maroon and gold.

“It’s not work,” Taylor insists, referring to all he does at the University. Students get the message right away. Very often, gracing the top of a Taylor syllabus will be the words “It’s always a great day to be an Eagle.”

At this stage of his career, he has considered setting aside his own practice and devoting full energy to teaching, but his students are actually a big part of the reason why he keeps a hand in the business. “I think I’d lose my edge if I weren’t practicing,” Taylor explains, referring to his effectiveness in the classroom. “You could read all you want, but unless you’re on the front lines, experiencing it”—there was no need to complete the sentence.

William Bole is senior writer and editor at the Carroll School.

Photography by Gary Gilbert.